This article should serve as a cautionary tale for anyone who cares about the Rule of Law, and our constitution.

Our founders understood that private property is essential to preserving freedom, because without solid private property law, there is no individual autonomy. This is why in repressive socialist societies such as the old Soviet Union, allowing private ownership of property was considered so revolutionary. It facilitated freedom.

Less well understood is the importance of honest money in a free society.

Modern money is no longer a thing of intrinsic value. You can’t eat it, or wear it. It has value only because everyone agrees that it has value, and we have absolute confidence that it will have value tomorrow, and that our right to hold it—as long as it was obtained legally—is beyond question.

So why is the Federal Reserve a threat to freedom?

Imagine the Fed facing another “armageddon”, and holding the belief that it must repeat its tactics of 2008 to “save” the economy. For all the protestations to the contrary, this is a very simple thing. In 2008, the Fed created a large quantity of money, and through the banking system caused more to be created.

It is obvious to anyone with the slightest economic literacy that anything that is abundant is worth less. If money is handed out on street corners to anyone who wants it, it will cease to have value.

How much money can the Federal Reserve create without destroying our confidence in the value of our money?

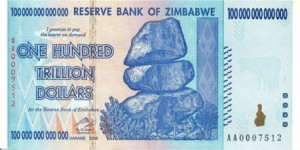

Mr. Bernanke and his supporters poo-poo this as unlikely, but hyperinflation is not in any way theoretical. It has happened many times, and always occurs when political necessity overwhelms fiduciary duty—exactly the rationale for the actions in 2008.

When our money is worthless, what of our freedom? When our IRAs and 401Ks evaporate, what of our security?

The Federal reserve is a hugely powerful institution. It needs to be prudently overseen, not given the almost unlimited discretion that it currently enjoys. If we fail to control the Fed, it is not Greece we will become, but Zimbabwe in 2009, or Germany in the 1920s.